If you are looking into the possibility of buying silver bullion, there are a range of factors to consider. In this article you can explore the advantages of owning physical silver, the affordability of silver compared to gold, and its resilience in times of economic uncertainty. Learn how to buy and sell silver with confidence in this essential guide.

Why should I buy silver?

There are many reasons why people choose to buy physical assets like silver. Firstly, silver’s ‘physical’, tangible nature can provide a feeling of security, unlike digital assets which can be vulnerable to potential hacking and cyber threats. Owning silver coins or bars allows investors to physically see, collect, touch, and safeguard their own assets.

There is belief that during periods of economic uncertainty, holding tangible assets such as silver can be advantageous. Unlike intangible investments, such as equity shares which can experience major price fluctuations during times of financial instability, silver’s physical presence can offer stability, serving as a hedge against market turmoil.

Another reason that people choose to hold silver is due to its affordability relative to gold, making it accessible to a broader range of buyers. Its lower price point enables small amounts to be purchased and added to a portfolio at a pace that suits most budgets.

Purchasing silver coins and bars can be a great way to diversify a portfolio, and their cost-effectiveness often make them affordable for the average individual, meaning that those who may not be able to afford to buy gold can easily enter the precious metals market and create their safe-haven asset portfolio.

In summary, silver bullion can provide tangible security, stability during economic uncertainty, affordability, and portfolio diversification options. Adding silver to a portfolio can be a valuable option for those looking to protect their personal wealth.

How much should I pay?

The price you will pay for silver coins and bars is dependent on the silver spot price. This price fluctuates constantly so it is important to keep up-to-date with the current price and then research which bullion dealers are offering the best deal for you.

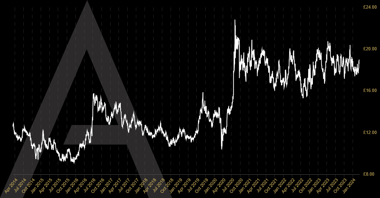

‘Spot price’ is the term used in the precious metals market that specifies the current price for 1oz of silver. This price constantly fluctuates and is the standard used by most dealers around the world to set the prices of their products. The price of silver has experienced significant fluctuations over time, and although often seen as volatile in comparison to gold, over the last ten years the price of silver has performed well, rising in the long term by over 8%.

One noticeable peak occurred in August 2020 when the price reached £21.49 per ounce. However, the highest ever silver price occurred in April 2011 when the price soared to £29.26 per ounce.

The spot price is influenced by a combination of factors, including:

- Global supply and demand:

Silver is a commodity which is globally traded, and so its price is heavily influenced by supply and demand. Factors such as industrial demand, investment demand, and supply constraints can impact the price of silver.

- Currency exchange rates:

Silver is priced in US dollars on international markets. Fluctuations in exchange rates between the US dollar and the British pound often affects the price of silver in the UK.

- Inflation and economic uncertainty:

Silver is often seen as a hedge against inflation and economic uncertainty. The current strength/weakness of a currency as well as inflation levels can influence investor sentiment and, consequently, silver prices.

- Investor sentiment:

Investor sentiment can also impact silver prices. Events such as geopolitical tensions, central bank policies, and changes in interest rates can affect investor perceptions of silver as a safe-haven asset, leading to high demand and a change in prices.

- Silver mining:

The supply of silver is influenced by mining production, and these levels can be affected for a variety of reasons. Any disruptions or changes in mining output can affect the supply of silver.

The silver spot price is always displayed on our website, and our dynamic price charts also provides real-time updates, ensuring you have accurate information on the current and historic price of silver.

It is nearly impossible to buy silver coins and bars at spot price, as traders need to charge a premium. The spot price does not account for the costs associated with the purchase or sale of silver, including the acquiring and manufacturing of the products, as well as the silver trader’s costs associated with running a business.

Researching the current spot price and understanding the costs associated with the sale or purchase of silver is important in order for a client to purchase their metals at the best price they can.

It is also worth noting that all new silver coins and bars are subject to VAT at the standard rate of 20%. VAT may not be charged on many pre-owned silver coins if they comply with the UK Governments Margin Scheme. VAT will be charged on all silver bars and rounds, whether pre-owned or new, as they are not classed as silver coins and as such, they are not “collectable” and do not comply with the Margin Scheme legislation.

How to buy silver

When first looking into buying silver, it is crucial to start with research. Understanding the factors that influence silver prices as well as being aware of the various available options sets a solid foundation. It is then important to set a budget which aligns with your personal financial goals. Regularly monitoring the price of silver and utilising tools like live price charts, ensures you stay well-informed about any movements in the market.

There are a variety of options when it comes to purchasing silver, and each choice offers its own advantages. Silver bullion coins are available in various sizes, often featuring attractive designs meaning they can also offer collectable appeal. The smaller sizes of silver coins also offer flexibility when selling at a later date because they are easier to trade, making them a popular choice. On the other hand, silver bars, ranging from smaller denominations to larger weights, often appeal to those looking to maximise silver bullion weight while keeping premiums minimal. Regardless of your preference, buying from a trusted source is important.

When to buy silver is a personal choice, influenced by market conditions and your own personal financial goals. Some choose to buy silver in small quantities when they have the budget to do so, building their portfolio steadily. Others choose to wait until the spot price of silver hits their target amount and then purchase a larger amount. Regularly reviewing your portfolio’s performance and making necessary